Sole Proprietorship

What is a Sole Proprietorship?

- Be certain that your company’s name, symbol, insignia and other credentials do not clash with an already registered entity; it could get you entangled in legal troubles,and slow down your progress

- Compiling necessary documents required for registration of your dream venture.

- Ensure minimal time is spent familiarizing with relevant statutes regarding the registration and inclusion of the name of your business in the register sole proprietorship in Alberta and Ontario.

- Undergoing Register Sole Proprietorship process.

Sole Proprietorship in Ontario

To register a Sole Proprietorship in Ontario click on the button below

Sole Proprietorship in Alberta

To register an Alberta Sole Proprietorship click on the button below

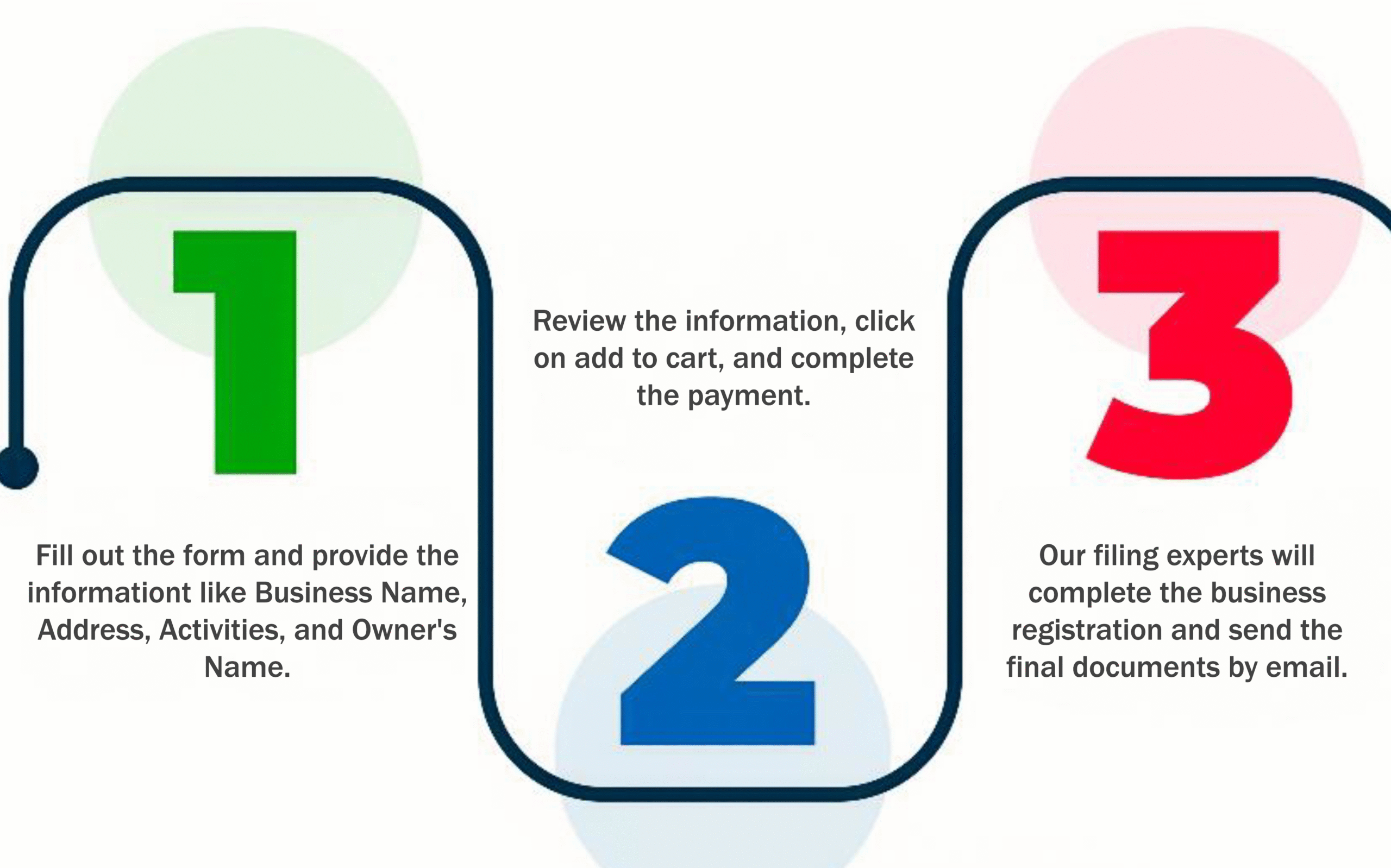

Know more about the registration process

Do not worry. We’re here to support you and turn your Sole Proprietorship journey into a seamless and pleasant one. We with our expertise in norms and requirements of Register a Business in Alberta, and Ontario Sole Proprietorship,and can counsel, guide and assist you in fulfilling the requisite preconditions:

- Making sure that there is no Name Conflict with an existing business;

- Assist you complete all formalities regarding compilation of necessary documents relevant to industry you are going to operate in; including,

- Owners Name and their identity;

- Physical address with all proofs;

- File applications for you, and keep a follow up;

- Receive relevant Business number; and

- Help complete other formalities.

Benefits of Sole Proprietorship

When you choose to register a Sole Proprietorship Alberta, you unlock several strategic advantages for your business

Quick to Start

Quick to start: No complex paperwork or high setup costs. Can be registered as fast as in 2hrs.

You are in control

No partners or board meetings—just your vision and decision. You will manage all the operations and select whats is best for the business without any interference

Less Regulatory Compliance

Fewer rules and filings compared to corporations or partnerships. Less time spent on managing paperwork more time for growth.

Direct CRA Tax Account Reporting

Business income is reported on your personal tax return means no separate corporate taxes and returns

Validity

Sole porprietorship Ontario is good for 5 years which can be easily renewed few months prior to expiry or 60 days after the expiry

Easy Banking

Eay to open business account as less paperwork due to the nature of business and manage the finances

Sole prop is a simple form of business where only 1 owner have total control on the business decisions.

NUANS Reports assess corporate/business name availability, necessary for business registration. Although the sole prop lies under Un-incorporated business but still we need to check for the current conflicts in terms of corporations and trademarks to avoid any deficiency letter.

Google search results rely on web searches and businesses with online presence. However, they cannot replace the NUANS Report, which cross-references names with various elements in the government database to generate accurate reports.

An Ontario Sole Proprietorship is valid for 5 years.

Business name can be renewed with in 60 days of expiry after that we can still proceed with the same name as a new registration.

Best practice for a business name is to add a distinctive and descriptive term.

- Full control over business decisions

- Simple tax filing (income is reported on your personal tax return)

- Minimal paperwork and regulation

- Easy and Inexpensive steup

Yes, sole proprietors can hire staff. You’ll need to register for a payroll account with the Canada Revenue Agency (CRA) and follow employment standards.

You can Incorporate with the same name at any time depends on the name availability and a NUANS report is required to check for any potential matching conflicts.